Sometimes humanity’s ability to totally f*ck over another person makes me sick. How do these scumbags could live with themselves? Look, I am a 100% pro-business capitalist; making money is good, and it is how the world works, but I hate crooks that steal.

Maybe I am naive, but I think a person should have some basic honor in how they do business. Crush your competitors, sure, agree, that is a must, but don’t purposefully lie, cheat, and steal, knowing the product you are selling your customer will destroy them.

Ok, so what exactly am I talking about, and why am I so mad at what a select group of lenders are doing to small business owners during this pandemic? All this and more in today’s video.

Recently I was approached by a small business lender that promises “approval in one day, funding in two days.” I am sure you have heard similar ads on the radio or received countless spam emails from one of the many companies offering these services. Anyways, they wanted to advertise on my YouTube channel and sponsor the 2022 #OpenForBusiness US Small Business tour. Before I agreed to accept their money, I researched them, and all I can say is, wow, these are some shady [donkey].

There are multiple different times of loan structures; some are merchant cash advances, others are invoice financing, and others are direct working capital lenders. No matter what term or structure is used, they are all hard money lenders—giving you a financial product quickly in exchange for a higher set of fees.

But it should come as no surprise to anyone these lenders charge significantly higher fees than what a bank would charge you for a similar loan. That is obvious, and by itself, not really a problem. As the business owner, you are willing to pay a little more in fees to get a loan funded quicker, and the lender must charge a higher rate to compensate them for the higher risk of lending. We all know that. I have no issue with the concept; until that is, I dug deeper into the terms.

The problem is, some of these lenders, while expensive, are not really a bad deal for you. Others, on the other hand, are down-right purposefully setting you up to fail, so let’s go over what the difference is between these two types of lenders so you can spot

Before I get into just how bad these terms are and what you need to be on the lookout for, let’s go over a bit of my history with some of these shady lenders because I know first-hand just how horrible some of these companies can be to work with.

Back when I was just getting AutoCorner off the ground, we were a brand-new start-up and short on cash. We were bringing in revenues of just shy of $750k a year. Not bad, but not enough to reinvest in hiring more staff and expanding. We approached banks, but this was just after the 2008 real estate implosion, and banks were very strict on lending, and because we were a new start-up, this was almost impossible to get the funding we needed.

If you watched my previous video a week ago on getting business lines of credit, you may remember I said the average line of credit for a new small business is about 10% of annual revenues, which should be about $75k in my example. But, as I said, it was just after the real estate crash, and banks were much stricter, so my only option was a loan from one of these lenders.

I went to one of the big names in the small business lending industry, but they would only offer me $18, now the estimated $75k I should have received from a bank loan. The agent was slick, and he convinced me, this is a “get your foot in the door” loan. Once I paid this back, I would have a track record with them, and they could lend me “much more” next time. The problem was $18k was almost useless to me; yes, I could use it for a small marketing campaign, but I needed a larger financial commitment before I could hire more staff, and that was what I really needed.

The terms were, well, not the best in the world, but oddly the total cost of the loan wasn’t the problem. Let’s break these down to see where the real scam is. As you can see, the loan for $18k has $2,417 in fees & interest, a term of 180 days, and weekly payments of $762. This means I am paying back $19,595.85 in 6-months, with $762 automatically debited from my checking account each week.

This calculates out to approximately 14% in interest paid out in 6-months, or if you annualized that interest rate, you are really paying the equivalent of 28% APR, which is an outrageous interest rate, but oddly, by itself, not really the big problem. In fact, if you borrowed the same $18k from a bank at a 7% interest rate with a 5-year term, you would pay $3385.29 in interest, so this “high-interest” lender is actually $968.29 cheaper.

Wait? What? [train crash]

But we haven’t gotten to the insidious secret yet, so follow along with me.

Borrowing $18k from this lender, they first remove $820.80 as a “platform fee,” basically, this is the commission to the broker, so now your $18k loan, is really only $17,179.20. This is already calculated in the $2417 in fees, so I guess they are not trying to hide it, but if you were expecting the full $18 grand, you would be in for a bit of a shock when the funds are deposited.

In the end, I took the loan, figuring it would “get my foot in the door,” and build a track record with the lender. At the time, that seemed reasonable, and I was willing to eat the $2,400 in fees.

The first big difference between the bank lending you the $18k over a 5-year term and this lender’s offering is being forced to pay back in 6-months. Thus, $3,048 is going out each month to pay this loan off vs. $356 to the bank. If you have a slow month and money is tight, you still have those weekly payments coming out. With the bank, you have much more flexibility, with only having $350 per month required. Of course, if you have a good month, the bank is happy to let you pay down your balance (and thus save on interest with the bank) with larger payments. But you are under no obligation.

About 3-months into this loan, the lender comes to me and says, “Hey, Steven, you’ve done a great job on the loan so far, and I was able to get you more money.” He was now offering me a loan for $32k, not quite double what the original loan was. But this still wasn’t enough; I told him I needed closer to $50. I was pretty ticked off, because when we first spoke three months ago, I told him I was looking for $50 - $75k, so he knew what I needed.

All he was offering was $32k, with, of course, the problem of, “this will build more track-record, and your next loan, I think I can get you the amount you need.” What a bait-and-switch. After a little more discussion, I found out this was a refinance of my previous loan. I still owed $10k there, which would be removed from my loan here, now bringing me down to $22k. But he hadn’t told me the worst part of the deal year. Because these loans are not calculated based on interest rates like a bank, you still pay the same lender fees if you pay the loan off early. Technically, I was borrowing money & paying fees, to repay their previous fees. I was paying the high lender fees twice of $10k of that money.

Because of the high monthly payment going out each month, most of the profit I made from my marketing campaign went directly to paying this loan off each week. I could spread those payments out with a traditional lender and reinvest my money back into the business over the 5-year term instead of 6 months.

This is where they really make their money. They lend you a little money, knowing it will put a rope around your neck, then come back in a few months later offering more money, but just enough to keep you going, never do they lend you enough money to get your business to the next level.

Of course, I turned down that second loan with these dirtbags, paid them the money I owed them over the next 3-months, and used this as a valuable lesson for myself.

Now, back to the present day, the lender that approached me to advertise, I told him about my past and how I am not fond of this type of lender. He acknowledged the industry had some bad players, but they mostly weeded those out, and his company offered new, unique lending options. I listed as he told me about their new credit offerings, and we went over a hypothetical business. He would lend the business a $50k line-of-credit that can be used and paid back as many times as the business needs during a 3-year term. It is interest-based, like a standard business loan with a bank, so you can save on interest by paying it back quicker.

It sounds like they have improved the products, right? Well, nope, they are still the same wolves in sheep’s clothing. The new way they screw you is by claiming an interest rate of 4%, but “accidentally” forget to tell you that is per month. That is 48% APR, much worse than the previous 36% from a few years back, and heck, that was when interest rates were higher across the board.

But you could say, hey, you can pay it down quicker without penalty because it is a line of credit. Sure, but then he hit me with the other fees. First off, there is a $500 per year annual fee to keep the line of credit open, plus you must pull $10k from it within the first 7-days after opening it. Then the topper on the scam, every pull you take from the loan, in addition to the interest you pay, has a lending fee of 2%. So that $10,000 you are forced to take within the first week costs you $200, plus you must pay the $500 for your annual lending fee.

Comparing to two, I would say, if you needed money quickly, perhaps to purchase inventory for a confirmed your you have. The line-of-credit wouldn’t be too bad, I guess, but honestly, get a line of credit from your bank ASAP and ditch these scumbag lenders to the curb.

In summary, I do not begrudge lenders from offering a product at high-interest rates. If they would just stop there, make their money on the interest in 6-months, and move on. What I do have an issue with is them purposefully lying about how the loans work and string you along with the prospect of more funding, all the while, they know they will never lend you the amount you really need and, in the end, put you in a situation where you are so deep in the hole financially you have no other option but to borrow more money from them just to keep your head above water.

If it wasn’t already clear, I turned down their $10k in sponsorship money because I did not want to endorse their scam.

Have you ever taken a loan from one of these lenders? Why, or why not? Or maybe you are. A lender that offers similar products, perhaps you can defend your industry? Either way, comment down below and let us know.

Don’t forget to check out www.OpenFor.Business and register your business today. As you know, this is my small business awareness campaign, along with Aubrey Janik, Jamel Gibbs, Minority Mindset, Investment Joy, Rod Squad, and Mark Moss; we will fly around the country in a helicopter landing at select small businesses nationwide. Do you want me to land the helicopter at your office or feature you on the program? Go to the website and register your business now. These spots are very limited

Follow Me On...

Steven creates video interviews with interesting people with extraordinary stories from various walks of life, sharing their successes and failures.

Full-length interviews and shorts are available on YouTube, with behind-the-scenes content and photos on Instagram and Facebook.

Keep Up to Date!

Subscribe to Steven's email list to be notified when new content is released!

Bell 206L4

For longer, multi-day, or multi-state trips, I usually fly a Bell 206L4 helicopter which seats two pilots in front and five passengers in the back.

R44 Raven II

For shorter, single-day, local 'Tampa Bay Area' videos, I usually fly a smaller R44 Raven II helicopter, which seats two pilots in the front, and two passengers in the back.

Get in touch

Have a suggestion for an interview or video?

- Corporate address

-

The Carlson Organization, Inc.

18 2nd Street

Luray, VA 22835 - Phone number

- +1 (540) 742-7001

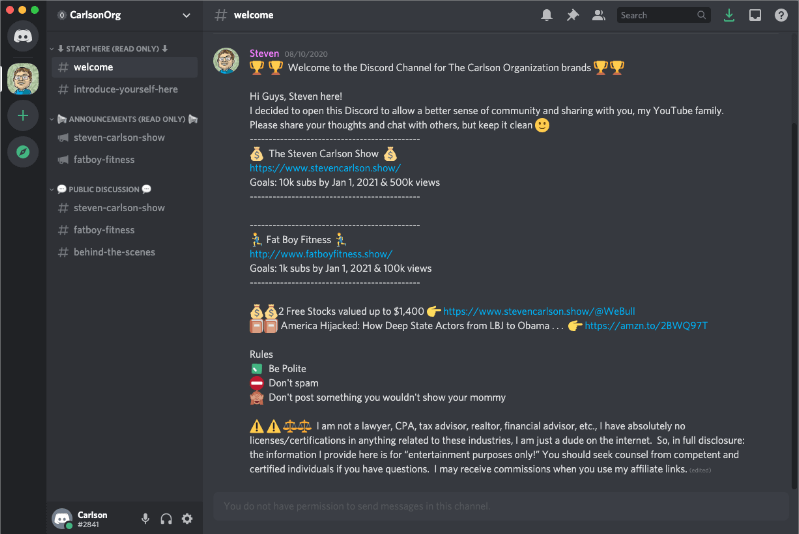

Join our community on Discord

Join in the discussion and share your insights with the community.

Join Now it's free

subscribe

subscribe