We all know that taxes suck, nobody likes to pay them, but we know how hard these taxes hurt us every year as small business owners. Then you pile on the dumpster fire of a year 2021 has been; we all need to save every penny we can get this tax year. Large multi-billion-dollar corporations have teams of CPAs looking for every angle to save them money, but what about us, the small business owner? We usually get shafted because we simply do not know about the tricks the big corporations use.

The #1 tax loophole for LLCs and S-Corps—all this and more in today’s video.

As we speak, we have 33 days until the first of the year, so of course, that means you only have 32 days to implement this loophole, but thankfully, you only need 14 days. But before we cover that, just a reminder, I am not an accountant, nor am I a lawyer, so use this as a starting point for you in your research and consult with a competent CPA before implementing any tax-saving strategies. Or said another way, if you do something stupid and get in trouble with the IRS, don’t sue me.

In one of my previous videos, I covered how smart business owners can take a tax deduction from their home office, including a unique loophole that allows you to write off your home office as a second business location, even if you have a physical business or storefront. Check out that previous video; search YouTube for Steven Carlson Show COVID Tax Savings Hack.

26 U.S. Code Section 280(A), the Disallowance of certain expenses in connection with the business use of home, rental of vacation homes, etc., is a section of the US Tax Code that allows you to take an additional tax benefit for small business owners. Best of all, you can take this credit on top of writing off your home office.

Basically, this loophole allows you to rent your house to your business for 14-days without having to report any of the income. The money you collect is 100% tax-free, but it gets better than that; you get to write off the amount you pay yourself as a business deduction.

So how does this work? Great question; let’s get started.

Section 280A of the Internal Revenue Code, which describes how you do the tax accounting for mixed-use homes, says that if you personally use a home at least 14 days a year and you rent the home for 14 or fewer days a year, you can exclude the rental income from your tax return.

This doesn’t sound like that big a loophole, and it is. But first, a little quick history on why this tax strategy came to be, this way we can better understand how to apply it to our situation.

Karlton Dennis has a great video showing the history of this tax loophole

As we learned, this tax code was designed if you own a home and rent it out for less than 14 days. For example, if your beautiful home is near the Augusta National Golf Course, where the Master’s Tournament is played, and you’re willing to rent out the house during the tournament. In this case, you could easily get $25,000 a week for the rental; that $50,000 of income for the two weeks is tax-free. This is a great deal. If your marginal tax rate is in the 40-50% range like many that live in that area, this loophole could be worth $25K a year!

Ok, that is great and all, but if you do not own a house near the Augusta National Golf Course, where else can you use this? This is where, as a business owner, you can also take advantage of this tax-saving strategy.

Now you need to be disciplined about how you set this up. If you’ve got a separate business–maybe you’re doing independent contractor work from inside an S corporation, for example—your business can pay you rent. Your business will get to deduct the rent on its tax return. But you won’t need to include the rent as income on your personal return. But often you can do this with excellent results.

Say, for example, that you own a condo at the beach. If you use the condo personally for at least 14 days a year, you can rent the condo to your S corporation for up to 14 days a year. Obviously, you need to have a real and robust business purpose for the S corporation to rent your condo. But a little cleverness should go a long way. For example, could you meet clients or potential clients where your condo is located for a few days?

And let me point out something that may be obvious but essential: In some resort areas, peak nightly rates are astronomical. I mentioned earlier the giant rents homeowners enjoy during the Masters’ Tournament. But you see that same phenomenon in many areas. I’ve got a friend with a lovely little bungalow in Palm Springs. The place is terrific –private pool, large fairway lot, maybe 2,000 square feet. However, during the Coachella and Stagecoach Music Festivals, the property rents for $10,000 to $15,000 a week. That pretty much pays for property for the year, even after allowing for wear and tear. So you could rent the place out and pocket the cash, or rent it to your business during the same time and charge yourself the “going market rate” for the area.

This may seem like a dishonest loophole, but it’s not. Businesses need meetings. Board meetings, tax planning meetings, shareholder meetings, and strategic planning meetings are just a few of the meetings that are necessary for a legitimate business. In most cases, a business would rent out a meeting room, conference room, or even a ballroom at a hotel. This rental would include charges for the space, state and local taxes, food, drinks, Wi-Fi, and any additional services.

You probably have a lot of the same things at your home: chairs, tables, food, drinks, and Wi-Fi. Why not just put that money in your own pocket instead of paying for a hospitality venue, like a hotel or restaurant?

This is where the IRS comes in. IRC 280A(g), or the “14 Day Rental Rule”, allows business owners to claim a home rental fee as a business expense. After all, if you weren’t renting the space from yourself, you would be renting it from someone else. And as long as the number of days on which you rent out your domicile to your business is less than 15 days, the income your company pays to your personal account is tax-free.

There is a small catch, the home you rent needs to have a place to prepare food and a toilet to qualify for Section 280A. Accordingly, a hunting cabin might not be eligible if it lacks a toilet, but recreational vehicles and boats with kitchens and bathrooms will qualify.

Additionally, the IRS only allows you to take this deduction on a primary residence that you are listed as the owner. So, if your house is listed in your parents, gf/bf, auntie, etc., then it does not qualify. Your name must be listed on the deed, of course, any of your other family members could be listed on the deed as well, the key is your name must be one of the persons listed.

I really hope this tip gives you something to think about; just remember to check with your accountant first.

Don’t forget to check out www.OpenFor.Business and register your business today. As you know, this is my small business awareness campaign, along with Aubrey Janik, Jamel Gibbs, Minority Mindset, Investment Joy, Rod Squad, Kenny Keller, Kristen Ottea, and Mark Moss; we will fly around the country in a helicopter landing at select small businesses nationwide. Do you want me to land the helicopter at your office or feature you on the program? Go to the website and register your business now. These spots are very limited

I am so excited to announce the support from AutoCorner, Namecheap, BestBuy, ZipRecruiter, Dun & Bradstreet, Constant Contact, and Unbanked. Without their support, this nationwide small business helicopter tour would not be possible!

Follow Me On...

Steven creates video interviews with interesting people with extraordinary stories from various walks of life, sharing their successes and failures.

Full-length interviews and shorts are available on YouTube, with behind-the-scenes content and photos on Instagram and Facebook.

Keep Up to Date!

Subscribe to Steven's email list to be notified when new content is released!

Bell 206L4

For longer, multi-day, or multi-state trips, I usually fly a Bell 206L4 helicopter which seats two pilots in front and five passengers in the back.

R44 Raven II

For shorter, single-day, local 'Tampa Bay Area' videos, I usually fly a smaller R44 Raven II helicopter, which seats two pilots in the front, and two passengers in the back.

Get in touch

Have a suggestion for an interview or video?

- Corporate address

-

The Carlson Organization, Inc.

18 2nd Street

Luray, VA 22835 - Phone number

- +1 (540) 742-7001

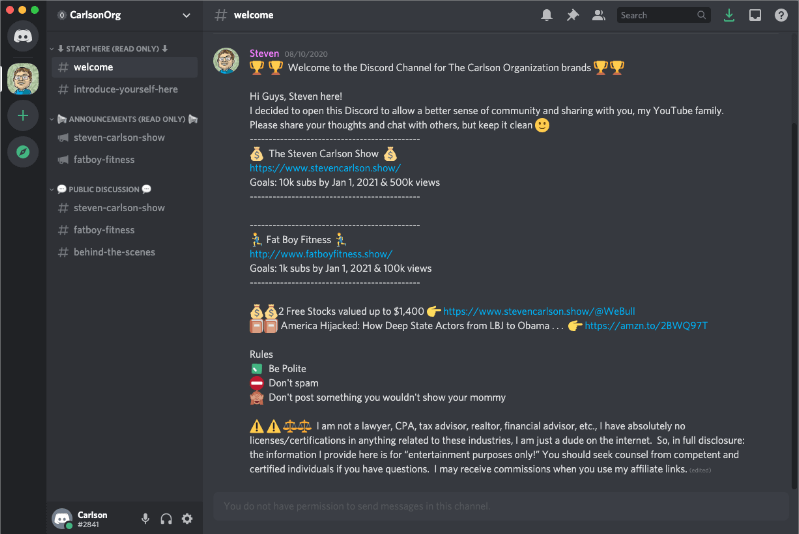

Join our community on Discord

Join in the discussion and share your insights with the community.

Join Now it's free

subscribe

subscribe